Any Person Can Handle Their Personal Financing With These Tips

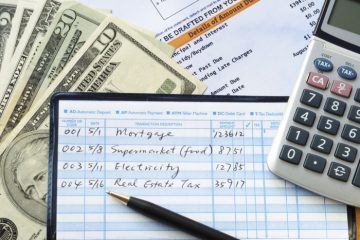

The procedure of maintaining individual money documents can be more than a little confusing. Preemptive activities and also consistent mindfullness of all that takes place in your monetary world can mean substantial savings in the future. With electronic banking as well as various other tools, your can improve your tracking procedure, yet you additionally require to remain in touch with where your cash is invested.

Recognizing exactly how to manage your financial resources will make you extra effective. Investing capital sensibly and protecting profits smartly will boost your wealth. Certainly, you require to invest some of your profit on financial investment, yet you also require to watch on that particular investment. Establish a percent of your revenue to enter into financial investments.

Getting your lean healthy protein in bulk will permit you to conserve time and money. Acquiring product wholesale is generally more affordable if you in fact use what you buy. A lot of time will certainly be saved by cooking every little thing in someday which will certainly leave you with food for the rest of the week.

Do not pay huge costs to invest your money. Service charge for brokers that assist with long-term financial investments prevail. The costs you incur influence your total returns. Stay clear of brokers that retain big compensations. You need to also try to sidestep funds that require unreasonably high administration costs.

It is an excellent concept to constantly submit your individual taxes when they schedule. If you will certainly be getting a reimbursement, file early to get your money more quickly. If you expect to owe money, you ought to file close to the April 15 deadline.

Rather than using bank card that are almost maxed out, spread it in between other cards. Paying interest on 2 lower equilibriums will be less costly than paying on a solitary card that is close to your restriction. This can serve as an excellent method in the direction of boosting your credit history over time.

Swap out your old incandescent light bulbs with the highly-efficient new small florescent lights. By changing your normal bulbs with high effectiveness CFL light bulbs, you will certainly decrease your electrical power costs, in addition to assist the atmosphere. As an included benefit, your CFL light bulbs will last longer than the average incandescent bulb. This will certainly assist you save loan on replacement light bulbs.

Make saving cash your very first priority each time you are paid. If you just intend on saving whatever may be left, you will certainly always spend every little thing. If you understand you the cash is in financial savings, you will be less likely to try to spend it versus having the money in your account with the intention to wait as well as being not able to prevent the lure.

Think about altering to a checking account which is free, or one which carries no service fees. Specific institutions, like on the internet banks or cooperative credit union, give free accounts.

Some individuals invest more than $20 every week intending to win cash in the lottery. It would be beneficial for them to save the money instead. This will guarantee that you do not lose any type of cash as well as will certainly improve your monetary scenario by enhancing your savings.

You should open up a savings account where you can sock away cash to make use of in the event of an emergency situation. Conserve some cash that will go to a goal you have, like repaying financial obligation or college savings.

Discover if any person in your household or among your friends has actually operated in money, as they can give you excellent advice for your service. If one does not have a good friend or relative who can help, they must do their own study online or by purchasing an excellent book.

If you know regarding your loan, you will revent overdraft charges and also various other money issues when something occurs. Do not count on a bank for your monetary scenarios as well as check it yourself!