Create A Prepare For Your Individual Funds That Functions

Understanding exactly how to take care of loan is a critical life ability that improves every facet of your life. Our ancestors had to learn to deal with cash the hard way. Until just recently, more youthful generations had actually not really felt the monetary capture. These suggestions will assist you acquire a brighter economic future.

Enjoy the Foreign exchange online forums to identify brand-new patterns. It is extremely important to frequently stay educated in order to know when to offer high or purchase reduced. Don’t sell on growths or drop-offs. You need to be figured out to recognize when you should ride out a trend.

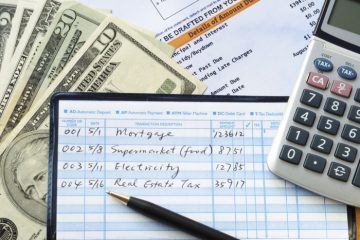

You can better recognize where your money goes when you make a note of just how much you spend every day. Having stated that, it is useless to create this down right into a small notebook that you normally shut out of your sight. Try to put up a white boards in the workplace or bed room that you can list your costs on. You will certainly see it frequently throughout the day so the message stays fresh.

Never ever rely on a credit score repair work firm that ensures your credit history can be boosted effectively. A great deal of companies don’t offer all the information concerning their abilities for repairing your background. However, this is a deceptive case due to the fact that the cause of your poor credit history might differ from the source of somebody else’s poor credit scores, as well as these varying aspects need different therapy approaches. To claim that they can clear your credit rating totally is certainly a lie and they are most likely committing fraud.

Get rid of incandescent light bulbs and also make use of CFL light bulbs rather. Replacing these bulbs can decrease your electric expense and also aid the environment. CFL bulbs have the added benefit of lasting a a lot longer time than typical bulbs. Acquiring bulbs much less often can help you conserve loan.

Consuming out much less can save a ton of cash throughout a year. Acquiring the ingredients and putting meals with each other in the house will save one loan, as well as giving one a gratitude for the initiative it requires to make good tasting dishes.

You can’t repair your credit score without leaving debt! Reduce on costs as well as repay financial obligations, finances as well as credit cards. Decrease your food expense by eating at house more and heading out much less on weekends. Making your lunch for job and eating in your home throughout the weekends and also during the night can considerably reduce your expenses.

Prevention is the most effective remedy for bank card debt. Prior to you buy anything with your bank card, ask on your own a couple of questions. Ask yourself how long it will certainly require to repay. If you can not pay a cost off within a month, you most likely should not be buying the product of solution, especially if it’s something you don’t genuinely need.

You need to get a savings account to conserve loan in instance of an emergency situation. In addition to conserving for unanticipated occurrences, you can likewise save for anticipated occasions, such as going to college, buying a brand-new cars and truck, or settling the equilibrium on a bank card.

Do you constantly find modification in your pocket? Beginning placing it apart as well as waiting. If one makes use of the left over dollar costs for scratch-off lottery tickets, they stand a chance to win a lot more than they spent.

Credit card financial obligation plays a large duty with your FICO rating. A higher balance equates to a lower rating. Your rating will rise as the balance drops. Reducing your complete amount of credit rating can play an essential function in enhancing your economic placement.

Learning about finances is constantly a great relocation. Knowing just how to invest your cash intelligently can aid you to sleep very easy in the evening. If you follow the recommendations given right here, you need to have a much easier time saving, investing intelligently, as well as usually reaching financial goals.