Personal Financial resources And Exactly How You Can Do Well With It All

Financial stress are among the best consider causing tension and clinical depression. This does not need to be you. No matter your economic situation, you can boost it by adhering to some extremely basic tips. Keep reviewing to get the knowledge required to make sure that you can conserve your personal finances.

It is very important for your broker to be a person you can count on. Examine their references, and also ensure that they inform you everything you want to know. You additionally require to be equipped with a decent degree of knowledge.

Generally, if an item has faults, you will certainly see it within 90s, which is the size of most service warranties. Typically, extended guarantees are unusable to you.

Stay clear of large charges when spending. Brokers that handle long term financial investments bill fees for utilizing their solutions. Your complete return can be affected by the fees they will certainly charge you. Maintain your investing expenses down by steering clear of from funds with pricey management costs and brokers that take big percents in commissions.

If you travel by airplane regularly, it may be an excellent concept to enter into a regular flyer program. There are a great deal of bank card business that award you with totally free or lowered airfare for making certain acquisitions. A few of the significant chain resorts also take constant flier miles in the direction of decreased prices, or perhaps complimentary accommodations.

For high-ticket items, make sure to shop around to obtain the most effective rate. If you want to obtain a good rate on a car after that your best choice is to take a look at every supplier where you live. Don’t fail to remember to look on the Web.

If you want to lower your Xmas budget, consider fashioning you own homemade Christmas presents. You can conserve hundreds of dollars around the vacations by minimizing costs at chain store. A little creative thinking can save you loan that you can utilize to develop your financial savings.

Obtaining the suggestions of member of the family that know economic issues or work in the money sector may be much more comfortable than getting advice from an unfamiliar person. If one does not have a person in their circle that fits this description, somebody one understands who is smart with their loan is the next finest selection.

A good strategy is to use automated withdrawals in order to pay your expenses in a prompt fashion. In the starting this may be hard, but quickly enough it will end up being routine like paying costs and your brand-new account will remain to expand much larger over time.

Conserve a bit day by day. Acquire your usual things wholesale, seek discount rates and vouchers and also store in different stores so you can contrast costs. Always look for food that gets on sale.

Staying out of financial debt is your best bet. You may require to get a loan for a cars and truck or a house. However, acquiring all your everyday requirements on debt is not a good suggestion.

Have you thought of a bank card that has benefits? If you thoroughly pay your month-to-month equilibrium on time and also in full, you may desire among these cards. An incentive card can provide you things like cash back and also airline company miles for making day-to-day acquisitions. Find an incentives card that fits you by contrasting the benefits offered.

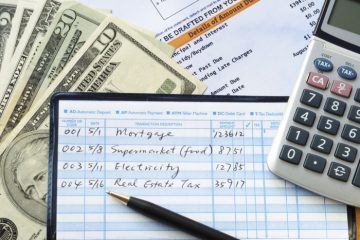

To be knowledgeable about how your loan is spent, track all of your expenses throughout an established period. A sincere budget plan will provide you an excellent concept regarding means to get rid of unnecessary acquisitions.

One means to reduce total expenditures is to see to it that your insurance policy coverage is maximized. You can check out things like getting rid of too much insurance coverage or packing policies. That will help you inevitably conserve a lot of cash.

Despite just how hard your circumstance is, you never ever risk your retirement financial savings to obtain out of a hard financial situation. There are numerous options available to you to deal with your personal funds. If you place your future in danger, you are setting yourself up for a big struggle in the future in life.

Have actually money subtracted from each income you get. Keep it in an interest-bearing account that acts as a reserve. Preparing automatic contributions to your cost savings will make it easier to develop an emergency fund to see you via tough times.

A credit score of at least 740 is preferable if you intend to get a home mortgage. Borrowers with high credit scores are qualified for lower rate of interest. If you should wait a little to get this score, it will deserve your time. Don’t make an application for a mortgage with poor credit scores unless it’s absolutely unavoidable.

Open up a few checking accounts so that you can remain within your budget plan. You can have an account that every one of your bills will certainly come out of and one that your pocket money goes into. It will assist you in maintaining good track of exactly how your money is invested, which involves seeing to it you can cover every one of your expenses.

It’s important that you save immediately, to make sure that you can handle your funds well. Saving loan must be a leading concern, not one that you maintain putting off. Consist of the amount you will certainly add to your savings every month right into your budget. Consider it as “paying your future,” and also when the future comes to be the present, you’ll have a great deal of money.

Since you are more knowledgeable about just how to manage your financial resources, you must see an improvement in your life. This short article should have offered you some insight concerning how you take care of any kind of monetary issues you may be having. When you have actually applied the ideas you have actually discovered here, pay it ahead as well as give this post to another person that might additionally benefit.