Remain In Financial Control With These Tips

It’s easy to bury your head in the sand by overlooking your monetary scenario. This write-up serves as a helpful device to assist you obtain a hold on your funds. Gain control of your personal finances now.

Don’t fall for get-rich-quick schemes or anything that guarantees simple, easy riches. Many people have actually come under the obtain rich fast plans found on the web. You ought to absolutely discover; nevertheless, carefully view just how much energy and time you take into learning. You do not want to spend a lot time learning that you are incapable to work and also earn a living.

Attempt discovering the best local restaurants that the residents consume to discover even more genuine food and better costs in foreign countries. Restaurants in popular traveler locations and also hotels will certainly overcharge you, so consider where the residents head out to eat. Not just will the food be tastier, yet possibly less costly, also.

Costly items normally come with a restricted guarantee that covers them for 90 days to a year. Companies makes a killing on prolonged guarantees, as well as they do not offer great worth.

Switch over to a free checking account. Check into neighborhood neighborhood financial institutions, online financial institutions and also lending institution.

The initial step to credit repair service is to leave financial debt. It all starts with making vital lessenings, so you can manage larger payments to your creditors. Head out to consume as well as part much less to save some paper money. Loading your lunch can save you large bucks. If you want to leave financial debt, you’ll need to reduce the amount you invest.

If you have a tendency to use great deals of money buying Xmas gifts, attempt making your presents instead. Quit giving numerous bucks to chain store over the holiday! You can be sure that creativity can actually keep your pocketbook complete.

If you have a great deal of one dollar bills, utilize them in some fun ways to boost your earnings. Single dollars build up quite quick as well as are barely missed out on with this saving approach.

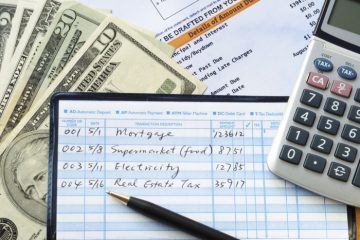

If you organize where your loan is going, you will constantly have an excellent take care of on your funds. Display your expenses and income, as well as examine your residential or commercial property’s efficiency a minimum of once a month. You should make sure you have a strong budget prepared that is possible.

To keep great costs practices and also managing yourself from blowing too much cash, allow on your own a specific quantity of cash every month to invest in individual items. The cash money can be used for treats like coffee with buddies, new songs, books or a brand-new set of footwear, but once it’s spent, you’re done till the following allocation. This is a means to permit yourself small deals with without spending outside your spending plan.

If you locate the job of balancing your checkbook by hand to be too much difficulty, you can do it on the internet rather. There are numerous programs as well as internet sites that take a great deal of the grind and also repeating out of doing it by hand. Additionally, these programs will certainly build up interest, cash flows and offer you some advice about budgeting.

Setting your checking account to automatically withdraw a set amount of funds right into a high-interest savings account can be an excellent concept. This may be odd, but it’ll come to be routine after a couple months. You’ll see it like a bill, and also you can watch the financial savings expand in no time at all.

Ask loved ones for advice on your credit history. This way, you will certainly not really feel negative when they try to welcome you out when you could not manage it. Several of your close friends may be upset if you refuse to go out with them without describing that you can not manage to. Maintain your close friends, just let them understand what is taking place in your life.

Jot down each cent you invest for a prolonged quantity of time. The very first step to resolving a trouble is knowing the nature of the problem, as well as tracking your expenses makes it very easy to recognize expenditures that you can scale back or even do away with.

Relative to getting your finances in better shape, it is much better to begin late than never. By doing this, you will be much more prepared at 60 than if you didn’t start whatsoever. Beginning to arrange your funds can just be good for you.

Surrendering a home is something everyone wants to avoid. That claimed, if your home loan is eliminating your financial resources, it’s most likely time to explore a cheaper location. You do not intend to be tossed out of your house for not paying your home loan. It’s ideal to be proactive regarding it.

If you have more money coming during the month, this is a sign that you ought to begin putting several of it way instead of spending all of it. Avoid this by sticking to your rigorous spending plan and never enabling your individual funds to experience once again.

Devote a minimum of someday of monthly to pay costs. You won’t in fact spend the entire day paying costs, but your costs having their very own day is essential. Mark this day down on your calender and also don’t overlook it. If you do miss now, it can create a cause and effect.

Utilize money or debit cards for small purchases. Don’t just count on your charge card for everything. Some shops will not approve charge card unless you acquire a specific quantity. Money and debit cards aren’t usually subject to this constraint.

Choose several examining choices in order to follow your budget. You can utilize one examining account to pay fixed regular monthly expenses, and utilize loan from the other for sporadic expenses. This will allow you to watch what you spend your loan on.

Seek ways to use the pointers from this short article to your own circumstance. Doing so will guarantee that you make more liable decisions connected to costs and saving. Gradually you will have the ability to have far better finances and also rid on your own of any type of tension that financial obligation can create.