Surviving On The Sea Of Personal Finance

Poor monetary monitoring is, sadly, something that is all as well common. Are you feeling like you do not know exactly how to take care of financial resources? If you aren’t, this short article will educate you how. This article is below to educate you just how to look after your finances better to ensure that you can be a lot more solvent. Comply with these basic actions to monetary health.

Do not waste your loan on get-rich-quick systems or any kind of other immediate cash program. Many individuals obtain suckered by Web scams. Spend time understanding, but bear in mind that the most essential point is to use that understanding successfully.

If you want to save cash when eating in foreign nations, you can attempt consuming like a neighborhood. Resort restaurants should only be your last hope. Do some on the internet research, or ask about, as well as discover some fantastic neighborhood places to consume. This way, you will certainly not be losing cash on specials as well as can enjoy the regional food.

Use two to 4 charge card to delight in an acceptable credit scores record. Just using one card each time makes it tough to accumulate a strong credit rating; nevertheless, using a greater number of cards than four makes it difficult for you to effectively manage your funds. Start sluggish with just two cards as well as gradually develop your way up, if required.

The two greatest acquisitions you make are likely to be your residence and cars and truck. Initially, the payments for large products will mostly go in the direction of interest costs. Pay them off quicker by adding an extra payment every year or using your tax obligation refunds to pay down the equilibrium.

Instead of maxing out one card, attempt to make use of a number of them. The interest from numerous charge card is generally less than a solitary card that is maxed out. In many cases, this won’t do much damages to your credit scores, as well as, if you manage your cards carefully, it might also assist you boost the state of your credit.

To fix your credit scores issues, the first step is to get out of financial debt. Do this by paying off your loan and also charge card financial obligations by making some lessenings. Points you can do which will certainly assist your scenario are consuming at house as well as cutting back on investing loan throughout the weekends. Pack a lunch for work and also refrain from dining in restaurants way too much on the weekends; this can conserve you quite a bit of money. In order to have far better credit history, you need to make some sacrifices.

Acquiring an automobile is a really major choice. The easiest means to obtain an economical price on your following cars and truck is to go shopping, shop, look around to all of the automobile dealers in your driving span. If you aren’t discovering a bargain, after that there is always the Internet.

Settle those credit cards that have high equilibrium and high passion initially. Bank card with high interest rates will certainly cost you lots of cash if you do not pay them off. This is very crucial due to the fact that prices are reported to climb in the coming years.

The best monetary choice one can make is to try to stay clear of debt entirely. A financing is suitable for getting cars as well as homes. In everyday life, do not depend on credit cards or fundings to cover your living expenditures.

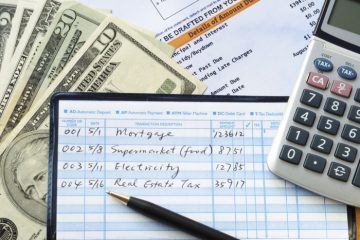

Learn how much you normally invest each month. Develop a budget plan that represents these costs. When considering your regular monthly costs, make note of high-expense locations where cutbacks need to happen. Not tracking your cash and where you spend it is just one of the major factors people end up in the red and without any financial savings. Take into consideration making use of some kind of money software as it makes the process simpler as well as much more pleasurable. Any type of cash that continues to be need to be designated to lowering financial obligation or raising your financial savings.

Among the easiest methods to restore control of your economic scenario is to tape each and every single expense for a couple of weeks. A comprehensive understanding of what you are spending loan on, can offer you a better more exact concept of the locations of costs that you can reduce on or perhaps, eliminate entirely.

Any reliable personal finance plan begins with a composed spending plan. At the beginning of each month, make a budget plan that includes a list of each expected regular monthly expense. You ought to include every one of your month-to-month expenses, consisting of utilities, insurance coverage, food and gas for your automobile. It’s additionally essential to consist of any type of expenses that you are anticipating. Some costs only happen every other month or two times a year, so it is very important not to fail to remember those. Jot down the amount you require to pay, and also never ever spend greater than what you gain.

When you have a month in which you make more cash money than normal, you shouldn’t spend the extra money, you ought to save it! Keep your financial resources on the right track by always staying within your budget plan.

Compounding passion is important to understand. Make an account just for cost savings, and automatically put a certain percent of your incomes into it.

See to it you dedicate a particular day every month to pay bills. You may not be lowering all your expenses on expense day, however it does require your emphasis. Take down it on your calendar and remember it. Missing this particular day might cause a poor domino effect.

No matter an individual’s economic circumstance, it is very important to have an interest-bearing account with liquidity. This account should have a high return. On-line financial institutions are one such facility that can provide you what you need. These banks are mandated to have FDIC insurance coverage so your financial savings are safeguarded.

Analyze your financial resources as if you were a financial institution policeman so as to get on the ideal track. That implies putting in the time to accurately find out your precise income in addition to your specific expenditures. Some of your costs, like utility costs, are variable. You ought to make a charitable estimate of such expenses for budgeting purposes, and after that you can spend any money left over in your savings.

Beginning making prepare for your future once you acquire control of your economic scenario. You can regulate the state of your funds and what happens to you in time.