Your Personal Financial Resources Can Come To Be Easy To Manage

Surviving a budget plan is hard, particularly if you are an university student or young person, with little experience. Instead of doing this, be liable in handling your funds in order to avoid of debt.

Remain updated with monetary information so you understand when something happens on the marketplace. It’s bothersome to overlook global news in favor of U.S. news if you’re attempting to trade money. By recognizing what is happening worldwide, you can forecast what the market is going to do.

Avoid extreme fees when spending. Complete brokers levy costs for services they offer. Your total return will be considerably impacted by these charges. It’s important to research brokers prior to you utilize them. Find out what their costs are along with any various other prices associated with collaborating with them.

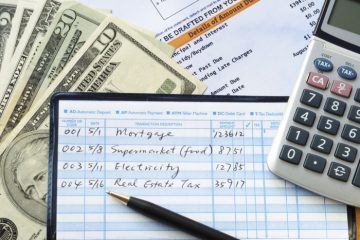

One way to get your funds fit is to intend purchases and also financial obligation paydowns, much in advance. Having a strong plan is an effective motivational tool, as it assists you to keep a benefit visible, which is a lot more rewarding than meaningless spending.

Your home and also your car will almost always be your greatest purchases. Payments and also interest rates are what will be a big part of your cost monthly. You can get these repaid quicker if you pay a little extra annually. You may wish to think about utilizing your tax obligation refund to do this.

Safeguard your funds by ensuring you have the proper medical insurance policy. It is inescapable that you will get ill time or an additional. For that reason, it is very important to have healthiness insurance policy. It doesn’t take long for medical bills to build up, and also even a small health problem can be very pricey. Expenses of this nature can wreck you monetarily without medical insurance.

Try negotiating with your financial obligation collectors. They are likely a scrap debt buyer that got your financial obligation for 10 cents on the buck or much less. Paying a little of what you have to pay can aid them still earn a profit. Keep this in mind when you deal with collection agencies to resolve your financial debt.

Make sure that you will end up in a safe financial circumstance before you pile up a great deal of financial debt with trainee financings. Picking a costly exclusive university without having declared a significant is a great way to land on your own in perpetual financial obligation.

Maybe the most reliable method to avoid jeopardizing your existing economic scenario is to avoid sustaining charge card financial obligation. Before you determine to make use of a charge card, think very meticulously. Prior to deciding to buy using a credit card, you should consider the quantity of time and the interest that will certainly be charged if you finish the purchase. Unless it’s a vital item, don’t buy even more on credit than you can manage to settle at the end of the month.

Avoid entering financial debt also much by learning how to appropriately budget plan as well as exactly how to invest your cash effectively to ensure that you make one of the most out of your loan. If you utilize the tips you read below, you won’t need to handle financial debt collection calls or being frequently in the red.