Excellent Tips For Controlling Your Personal Financial Resources

We need to have a mutual understanding of money to make it through. Older people discovered to conserve loan because they needed to. Generally people don’t live like that anymore. The following monetary pointers have some simple recommendations, which will assist you to handle your loan much better.

When you are out and around, bring an envelope with you. Utilize it to protect any type of invoices or business cards you receive. It’s a fantastic method to catch these products in a safe place to tape them in the future. It is always a sensible concept to contrast your receipts to the bills that you get to eliminate any type of errors or overcharges.

You personal economic health and wellness depends upon keeping your financial obligation in control. In some cases you can not prevent financial obligation (e.g. education lendings, home loans) nonetheless, you need to stay clear of debt such as that developed by charge card, as it can be dangerous. You will certainly lose much less cash to rate of interest and also feasible fees if you obtain much less cash.

There is a possibility your credit rating might drop when you are functioning to fix it. This ought to be short-lived and also isn’t a sign that you have actually triggered more damage to it. Your credit history will certainly rise as time takes place if you continue to add high quality information.

If you are married, you need to have the partner with the best credit get fundings. Attempt to improve your very own credit score by never ever bring an equilibrium on at the very least among your cards. Once you have both boosted your credit scores, you can share the financial debt obligation for future financings.

Obtain a bank account that is free. You can locate wonderful alternatives with on-line financial institutions, credit unions and community banks.

You should get an interest-bearing account to conserve cash in situation of an emergency situation. Perhaps you have a certain goal in mind that you wish to conserve loan for, such as attending college or a down payment for your own house.

Charge card guidelines have actually transformed recently, particularly for individuals under 21 years old. In the past, charge card were handed to pupils easily. Now bank card business want you to have a proven earnings or to obtain a cosigner. Before application to any particular card, take a difficult consider the requirements that come with it.

Being aware of the value of a product is critical when determining just how to deal with it. This stops a person from offering it away, placing it in the trash or selling it at an exceptionally low price. It can be a massive advantage to your spending plan if you figure out that your old table or chair deserves a few hundred or thousand bucks.

If any individual wants to purchase something as well costly for their earnings, attempt asking the household for aid. Possibly it is a third tv, and then you can get everybody to contribute.

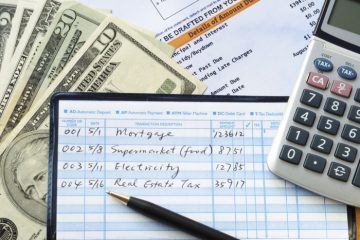

If you desire your property to remain in control, take note of your capital. Monitor your income as well as just how much you invest so that you can see exactly how your building is doing after every billing cycle. It’s a terrific suggestion to have a well-developed allocate your residential or commercial property to make use of as a reference.

To get out of financial debt promptly, repay your highest rate of interest financial debts initially. The greater interest cards will certainly create you one of the most gradually, as it is necessary to minimize these promptly. Remember that bank card prices should boost in the following few years; repay your accounts as quickly as you can.

Consider getting an adaptable account. FSAs operate as tax shelters, so you will certainly conserve loan on your tax costs.

Some people believe that by refraining maintenance on their residences and automobiles they are conserving cash. You could discover an expensive issue you might have avoided by looking after your car or your residence consistently. Over the long-term, looking after your property will save you loan.

Have you taken into consideration enrolling in a bank card that provides a rewards program? If you always pay your card equilibrium completely, you are a suitable candidate. Benefits cards compensate you with airline company miles, money back, and other ways, for daily purchases. Pick a card that offers benefits that thrill you. Compare offers from numerous such cards and also see which transforms the highest possible portion of purchases into incentives.

The most effective method to be successful with your financial resources is to have a spending plan that you have made a note of. Beginning your created budget by noting all of your regular monthly costs. Consist of every little thing from lease to food to automobile settlement to make sure that you can examine where you are spending cash. Don’t forget any one of your costs. Mark down the quantities that each thing will cost, and stay with what you have actually allocated.

Personal finance expertise is a fantastic tool to have. You can make your funds a lot easier to deal with when you track your expenditures as well as don’t spend loan without very carefully taking into consideration the repercussions. With the complying with suggestions, discover how to conserve and spend intelligently. Your financial goals are available.