Use These Tips To Aid With Your Personal Funds

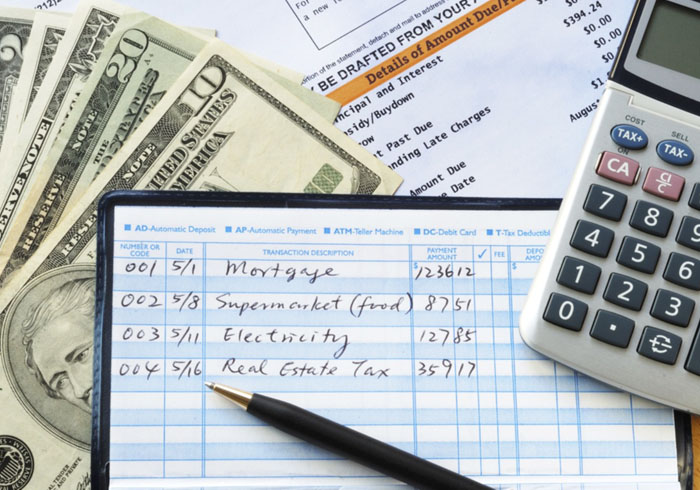

It can be rather tough to conserve your loan, specifically when so many various other factors action in to motivate impulsive investing habits. From in-store special promos to commercials on television, you have to be able to suppress your spending on a daily basis. In this article, we provide finance tips for every single day that will certainly make conserving cash a lot easier.

With this economic crisis, having multiple costs opportunities makes good sense. A savings account, check account, high rate of interest account and also supplies will certainly assist you take advantage of your cash money. Use these concepts to secure your money.

Do not pay large charges to spend your loan. Spending brokers managing long term scenarios bill service charge. These fees can take a huge bite of your returns, though, if they are big. Do not use brokers that take large commissions, and also steer clear of from funds with high administration prices.

Establish an automatic financial savings prepare with your financial institution to ensure that a particular amount of loan is transferred to an interest-bearing account every month from your bank account. This technique enables you to save a little loan monthly. It can likewise assist for huge acquisitions later on, like a getaway.

One finest practice for preserving healthy credit is to only make use of two to four various credit cards. Having just one card will make it longer for you to get a far better credit score, while 5 or more cards can make it tougher to manage finances. If you intend to build credit, maintain two cards as well as don’t add others unless required.

When you earn money, the very first thing you need to do is place some loan right into savings. If your intent is to just tuck away whatever dollars you still contend the backside of your pay period, your saving will certainly never start. Knowing just how much cash is currently made use of makes budgeting simpler. There will be less temptation to spend it and also more encouragement to save it.

Registering for a frequent flier incentive program is a wonderful way to conserve loan or be awarded if you fly frequently. There are numerous charge card that use incentives for acquisitions that you can use to obtain discounted and even totally free air price. Constant flier miles can likewise typically be retrieved at a range of resorts free of charge spaces or discounted keeps.

Acquiring a lorry is a huge cost. The very best remedy is to browse around and also look for the very best bargain on automobiles in your local area. You can sometimes find good deals on dealer sites.

Don’t throw away cash on lottery tickets. Put the money in your interest-bearing account rather. This warranties you enhanced income over an amount of time, rather than just getting rid of your loan.

Make certain to save for a wet day by creating a savings account for emergencies. Saving for certain goals, like college, is the best way to get ready for costs that you understand will remain in the future.

If you’re under 21 and you want to have a bank card, you need to be mindful that particular rules have actually changed with the years. In previous years, any type of college student could get a bank card. It is required to have evidence of revenue or a cosigner. Constantly research card requirements prior to you join.

As opposed to attempting to raise money to make a huge purchase, think about getting the financial backing of family members. If it is something that everybody could make use of as well as gain from such as a third television one can persuade their entire family to pool their money to acquire the item.

Among the most important facets of your FICO rating is the balance of your credit cards. The greater your credit card equilibriums are, the even more of an adverse influence they will carry your score. Once you begin to trim the balances, your score is sure to climb. See to it to maintain your card balance a minimum of 20 percent listed below its maximum restriction.

Things that you have to do when trying to be wealthy is to use less than what you make. Individuals who invest whatever they make, or continually invest more than they make and obtain to offset it, will certainly never collect wide range, because they constantly spend it as soon as they have it. Determine the quantity that you bring home, and design a budget plan that invests much less than your complete net earnings.

Speak with good friends concerning your funds. This aids them comprehend why you can not always head out when they extend invitations to you. By being sincere, your close friends will certainly not assume you are mad at them when you can not most likely to supper. Discover cheaper ways to enjoy with each other and share your economic issues with them.

Attempt to save also a small part of your loan each day. Instead of going shopping the very same market all the time and making the very same purchases, peruse the regional papers to locate which stores have the most effective bargains on a provided week. Make certain you are willing to buy on-sale food.

Have you thought of a credit card that uses benefits? If you thoroughly pay your regular monthly balance on time as well as in full, you may desire one of these cards. Incentives cards are a fantastic method to earn cash back, air miles, and also reduce various other expenditures as well. Locate which sort of benefits are appealing and contrast the deals they offer you based on the portion of the purchases you do often.

No one wishes to experience the procedure of losing their home. Nevertheless, if it your economic situation can be enhanced by it, you must consider try to get a residence with cheaper repayments or lease. Foreclosure and also eviction are absolutely worst-case scenarios. Occasionally it’s a great suggestion be preemptive.

Just as you know, saving money is not constantly very easy. The trouble associated with conserving up money rises when you require to spend more. The monetary tips consisted of in this short article, if applied correctly, will certainly help you to save a large amount of cash.